A Tax Map for Businesses

Most businesses encounter seven key taxes throughout their lifecycle. Identifying which taxes may apply to a given transaction is more than half the challenge. With the right structure in place, tailored support and expert guidance can ensure you reach the correct outcome.

Please note the below content is related to UK taxes.

Taxes often evoke a wince, a sigh or even an expletive, and not just from business leaders. A complex mire of conventions, rules and procedures making many feel lost and frustrated. Everything associated with taxes seems costly and time-intensive. This article attempts to stand back from the mire and create a simple map to navigate the world of tax with confidence.

Most businesses encounter seven core taxes throughout their lifecycle. Knowing which tax applies to a transaction is more than half the battle. Planning ahead and being aware when taxes might impact your business will move it away from simple compliance to a more strategic approach.

Here’s a breakdown of the seven key taxes and where they commonly arise for most businesses.

Corporation Tax

Tax on business profits. Unfortunately more profits likely means more taxes. And the more variety in business activities means the more nuances in a company’s tax position.

Corporation tax (CT) applies to the trading profits of limited companies, but there are numerous rules about how it’s calculated and when reliefs apply.

Taxable profit ≠ accounting profit – adjustments are needed to accounting profits, for tax-deductible items and non-allowable expenses, to arrive at taxable profits.

Trading and non-trading income – trading (profits), property (rental) and other (e.g. interest) forms of income are all within scope of CT. All forms create taxable profits.

Reliefs - there are numerous reliefs that can help reduce taxable profits. Such as research & development (R&D), annual investment allowance (AIA) and chargeable gains reliefs.

Losses - they can be offset against taxable profits from other periods. There are several options, a bit of planning and thought is required to achieve the desired result. A balance of cash flow and maximising tax reduction must be considered.

Compliance - stay on the right side of HMRC. There are notification, filing and payment requirements. A simple tax calendar and planning will keep a business up-to-date.

Top tip: Engage in tax planning as early as possible, it can identify significant relief opportunities and avoid nasty surprises.

VAT (Value Added Tax)

Applied on the supply of most goods and services. Adding up to 20% to the price of anything typically grabs attention, and businesses become particularly studious about the detail included on invoices.

VAT can be a complex tax and errors can be common. However the position for most businesses is relatively straightforward as long as they remember some key principles.

£90,000 turnover threshold – Once taxable turnover exceeds £90,000 within any 12-month rolling period, registration is mandatory.

Different rates - Not all supplies are treated equally, there are zero-rated, reduced-rated and exempt. Once a business initially establishes their typical supplies the rates infrequently change. For new transactions or supplies, a bit of research and simple advice will allow the business to adopt the right approach.

Place of supply - the place of supply rules determine where VAT applies and therefore what business is responsible for accounting for the VAT. Similarly to the differing rates, once initially established the rules for place of supply will not change frequently. Be pro-active in discussions with suppliers and customers, they will also want to ensure they adopt the right tax treatment.

Electronic filing - it is now mandatory for most VAT-registered businesses. HMRC’s making-tax-digital (MTD) approach requires digital record-keeping and compliance submissions. Most accounting and tax software have built automatic connections with HMRC to meet the MTD requirements.

Different schemes are available - there are a few different schemes aside from the most common quarterly submission and payment approach. There is the flat rate cash and annual schemes, typically available to smaller businesses. Such schemes can simplify arrangements, but it is worth doing some brief research and seeking advice before implementing.

Top tip: Invest in regular advice when conducting new transactions, supplies and contracts. The potential tax savings and avoidance of penalties are often significant. Use digital automation tools for compliance.

Income Tax

Affects all employee remuneration and benefits. Almost ubiquitous in its impact on taxpayers, it dwarfs all other taxes in terms of government receipts. As a result it is comparatively well dealt with by taxpayers.

While employees pay income tax via PAYE, the business has strict obligations as the employer.

PAYE and Real Time Information (RTI) Reporting – the employer is obliged to calculate the PAYE liability and withhold the taxes, report and pay to HMRC each month. Tax codes are used to calculate the tax owed, submissions can be made via HMRC’s website but typically payroll or accounting service providers have their own integrations.

Benefits in kind – these include benefits such as company cars, medical insurance, gym memberships etc. From 6th April 2026, all benefits will need to be included within monthly payroll calculations, so employers must calculate and include in each month the cash equivalent value of any benefits provided to employees.

Director remuneration – salary and dividend are treated as different types of income and therefore different tax treatments are adopted. Dividend income is not included within PAYE income, it is taxed separately via the self assessment process.

Expenses policies – employees can be reimbursed in full without the payments being taxed as income if the expenses were ‘wholly, exclusively and necessarily’ for the purposes of the trade. The definition of ‘wholly, exclusively and necessarily’ can be a little tricky to pin down, but some research and where needed some advice will guide employers in the right direction.

Top tip: Work with benefit providers to understand the value of benefits, they will likely have come across the issue before. Some independent research and consulting HMRC’s guidance will go a long way to making the right decisions. Where it is a little more complex, seek some professional advice, the work and cost will be worth it for peace of mind and avoiding penalties.

National Insurance

Contributions from both the business and the employee. National insurance contributions (NICs) enable entitlement to certain social security benefits (e.g. the state pension, maternity / paternity, statutory sick pay). Often contributions are overlooked as they are lumped in within income tax. But the contributions are not as pervasive as income tax, there are distinct rules and costs to businesses (and employees). There are certain forms of income outside of the scope of NICs.

Employers have the obligation to pay their own and their employees’ NICs, typically as part of the PAYE and RTI framework.

Employer’s NICs - up to 15% is due on the gross salary and bonus costs of each employee. There are threshold limits depending on the level of wage / salary.

Directors - the treatment can differ as directors may not be paid on regular intervals like employees. If so, the NIC liabilities are calculated on a cumulative basis throughout the year.

Class 1A NIC – payable on a variety of employee benefits. The contributions will be due each month as part of the PAYE and RTI framework, as all benefits bar a select few exceptions must be included in periodic payroll processes, rather than a year-end procedure.

Reliefs – such as the Employment Allowance (up to £10,500 pa). There is eligibility criteria to be met, although most businesses should qualify. HMRC guidance and most payroll providers make obtaining reliefs a straightforward process.

Top tip: Payroll providers and software are very well versed at calculating NIC liabilities. The key task for businesses is to ensure the input data is accurate, such as salaries, employment type (directors) and value of benefits.

Stamp Taxes

Tax on property and share purchases. Normally first encountered by taxpayers when purchasing a first home, it can be quite a shock as the tax liability can be significant. As property and share transactions become more complex so do the rules for stamp taxes, even hardened tax advisers can winch at the nuances involved.

Stamp duty applies in specific, often high-value, property and share transactions. Always paid by the purchaser, shares and property.

Stamp Duty Land Tax (SDLT) – charged on the completion (not exchange) for commercial or residential property. There are differing rates and brackets for commercial and residential properties, with commercial rates being lower. Be mindful that consideration includes VAT, as well as inclusion of contingent, uncertain or unascertained consideration.

Stamp Duty on shares – applies to private share transfers. A 0.5% (sometimes 1.5%) tax is levied on the share transfer value, but only if the consideration exceeds £1,000. There are also some exemptions on the type of instrument (e.g. units in an ETF) and upon certain events (between group companies). For a share transfer to be formally registered it must be officially ‘stamped’. Consideration can be cash, share or debts.

Short payment window – for shares there is a 30 days window from the date of the transaction. For land transactions, the window is shortened to 14 days post completion.

Corporate transactions – partnerships, incorporations, group restructurings or M&A transactions all have nuances and exemptions to consider.

Top tip: For any significant property and share transactions have a mindset that stamp taxes will apply. Seek advice on mixed use properties, potentially linked property transactions, restructuring and M&A activity. Changes to steps and papering of transactions can mean a significantly lower tax liability.

Capital Gains Tax (CGT)

Charged on the profit from selling assets. Often perceived as a tax on wealth and impacting a select few businesses and individuals, yet as businesses engage in ever more varied activity and individuals hold more business assets the application of CGT is growing.

There are capital gains regimes for individuals and companies. It may impact a business owner in both a personal capacity, as they sell shares or assets, as well as within a company structure.

For Individuals:

Asset disposals in scope - Applies to disposals of numerous assets shares, land, property, crypto, goodwill and IP. The legislation lists exempt assets rather than including specific assets that fall within the regime.

Reliefs:

Begins with an annual exempt amount, which for the 2025/26 tax year is £3,000.

Tax reducing reliefs, that can reduce the CGT rate to as low as 10%, on disposal of qualifying assets and criteria. Such as Business Asset Disposal Relief (BADR). Principal private residence (PPR) relief can exempt gains on an individual’s main and private residence. Business property relief can eliminate gains on qualifying assets being passed on as inheritance assets.

Deferral reliefs, such as gift and rollover reliefs that can move the CGT liability to a future event. Inter-spouse transfers are at ‘no gain no loss’, so no tax is charged until a disposal is made to a third party.

Incidental costs of disposal such as legal fees and advertising are deductible, as are associated costs of acquisition such as legal fees and stamp duty land tax.

Numerous rates - there are differing rates for lower and higher income tax payers. As well as residential property which have higher rates.

Timing matters – it is very important in exit or succession planning. As well as significant events such as incorporating a business.

Administration - gains on residential properties must be reported and the tax paid within 60 days of completion. Other gains can be reported and paid as part of the self assessment return.

Top tip: There are significant interactions with inheritance tax (IHT), so make sure both taxes are considered together when disposing of capital assets.

For Companies (Chargeable Gains Regime):

Corporation tax - chargeable gains are calculated similarly to individuals, as noted above, proceeds less cost and incidental costs. The chargeable gain is included within a business’ taxable profits.

Tax rates - as any gains are included in taxable profits they are taxed at the applicable corporation tax rate for the company.

Reliefs - there are fewer types of relief. However gains can often be exempt when selling a significant shareholding, such as that in a subsidiary, via the Substantial Shareholding Exemption (SSE). Deferral reliefs are also available to rollover gains to a future disposal event when proceeds are re-invested in new business assets.

Capital losses - can offset future chargeable gains. However capital losses cannot be offset against trading or other profits.

Top tip: Disposal of capital assets will bring about taxable events, but also numerous opportunities to gain relief. The calculations and criteria can be a little complex but applying the basic rules can materially reduce tax liabilities.

Inheritance Tax (IHT)

Applies on transfers of value and wealth succession. Sometimes referred to as a ‘death tax’, which is a little sobering. Business leaders will want to know how the assets they have worked so hard to accumulate during their lifetime are dealt with as they seek to pass them on to the next generation.

For business owners, their wealth is often largely invested within their business. Extracting, transferring or realising this value should initiate IHT (and CGT) planning, especially where succession is a goal.

Value transferred – IHT transfers are measured on the basis of the loss to the donor’s estate. Related property, typically owned by a spouse, needs to be considered. Transfers at death and in the 7 years prior are considered within the IHT calculation. Transferred value is subject to a 40% tax rate, after applying certain reliefs.

Reliefs:

Nil rate bands - up to £325k of transferred value is not charged to tax. It is commonly known, but there are nuances. Including a more recent additional ‘private residence nil rate band’, which allows for additional nil rate band if there is a private residence in the death estate being passed to lineal descendants.

Annual exemption of £3,000 which can be carried forward one tax year, if unused.

Inter-spouse transfers - gifts to spouses are exempt, and unused nil rate bands can also be transferred on death.

Business Property Relief (BPR) – certain transferred business assets, typically a trading company or assets of a trading company, are fully or partially exempt from IHT. Agricultural Property Relief (APR) works in a similar way for agricultural assets. There are ongoing proposals to cap the level of exemption for BPR and APR, so it’s important to stay up-to-date with the latest legislation.

Interaction with CGT - CGT and IHT are known as the ‘capital taxes’, each should be considered when disposing of business property. Timing and events could trigger one or both, so planning for a desired outcome is key.

Top tip: Ownership structure and shareholder agreements can impact relief eligibility – review these periodically with tax and legal advisers.

Conclusion: From Complexity to Clarity

A mind map of the relevant taxes creates awareness. Using this awareness, with some basic research with modern tools, can make you much more informed. There are complexities, continual legislative changes, the importance of timing and understanding business (and personal) context mean getting advice early where needed will be beneficial. The results will speak for themselves.

Plan proactively for growth, changes, sales or succession.

Avoid penalties and errors.

Unlock cash savings and reliefs.

Disclaimer:

The information provided in this blog post is for general information purposes only and does not constitute tax, legal, or financial advice. It should not be relied upon for making decisions or taking any action. Tax laws and regulations change regularly and may vary depending on your specific circumstances. You should seek appropriate professional advice from a qualified tax adviser before acting on any of the information contained herein.

Demystifying Treasury

At first glance, a treasury strategy might seem like a complex concept, relevant only to large, multinational corporations. But when you break it down, it’s a straightforward framework — essential for any business that wants to manage its finances effectively. For SMEs, getting it right can unlock greater control, resilience, and a real competitive advantage.

The term ‘treasury strategy’ often conjures images of small specialist finance teams in large multinationals playing in the world of dark arts and obscure finance activity. For many business leaders, it can feel like something distant, overly technical and not obviously relevant. But treasury in its simplest form is about how a business manages its cash, plans for the future, funds its ambitions and navigates financial risk. This short explanation will hopefully provide a practical framework for businesses.

Far from being a luxury, a structured approach to treasury is a source of resilience and control. And for many businesses, it can become a key source of competitive advantage.

Here’s how to approach it across four core pillars, cash, planning, funding, and risk.

1. Cash is King

Cash is fundamental to business, it’s what keeps all aspects of operations moving. But managing cash is not just about knowing the balance, and having a high cash balance is not necessarily a good thing. It’s about understanding the levers, timing, the most effective utilisation and building an infrastructure that allows businesses to optimise it.

To manage cash effectively, there are a few essentials:

Real-time visibility

Implement systems to monitor cash daily and provide insights into the key drivers. This enables informed decisions and reduces firefighting.Operational efficiency

Review internal processes to ensure cash is being utilised effectively. This includes invoicing, billing cycles and supplier terms. The goal is to shorten the time to get paid and reduce the holding period of inventory, whilst increasing the time for making payments. This will unlock liquidity without external funding, sometimes you’ll hear this labelled as ‘optimising working capital’. Using external funding will reduce profits due to fees and interest.Defined working capital needs

Determine the level of cash required to operate the business comfortably. Excess idle cash may indicate inefficiency, the business could be generating more profit. Idle cash could be used to fund better terms with customers and suppliers, increasing demand or lowering costs.

Professional insight: Create visibility, understand the drivers of business cash, make simple operational changes before solving the problem with funding

2. Planning to Creating Headroom for Smarter Decisions

Planning within a treasury context is about being prepared, so the business can respond confidently to uncertainty, growth or disruption. Time for planning in any business feels short, but it must be seen as an evolving and iterative process. With consistent efforts and dedication it will develop over time to be a powerful tool.

Some practical steps to start the planning process and infrastructure:

Align cash flow with business objectives

Expansion, hiring, product development all require cash (capital). Planning ensures the business can meet these commitments without compromising day-to-day operations.Build scenario-based forecasts

Build financial modelling for your expected performance, keep it simple and invest time in the fundamental business assumptions and drivers. And then tweak the key assumptions and drivers to create upside and downside cases. The planning process should not identify anything unknown, it allows the business to reflect its vision in financial numbers and importantly challenge key assumptions. This will help shape strategy and objectives.Prepare a contingency plan

Once the business is aware of the downside possibilities, it is important to consider the contingencies, sometimes known as mitigating actions:where are the sources of emergency liquidity;

what are the internal levers to preserve cash; and

what buffer would be required to remain operational in a downturn.

Professional insight: Planning is an iterative process which develops into a competitive advantage with consistent effort. It is a practical mechanism to implement a vision, challenge assumptions, evolve a strategy and plan for undesired events.

3. Funding to Meet Objectives

Access to funding is a common challenge for businesses. It is not just about availability, but it is also suitability. Suitability has a multitude of parameters, aligning availability and suitability is the key to unlocking successful funding.

Some of the key considerations are as follows:

Establish relationships early (availability)

Avoid seeking funding under pressure, as there will be negotiations. Being proactive will put the business on the front foot and avoid ceding leverage in the negotiation. Build rapport with lenders and investors, find the right communities and build a trusted network. Communicating plans to a strong network will ensure the right facilities are in place well in advance of need.Match funding to purpose (suitability)

Funding is required for different time horizons, depending on the business objective or problem at hand. Short-term needs are best funded by banks and specialist industry finance providers. Whereas longer-term needs typically require a strategic partner that buys into the long-term vision of the business. Be aware of covenants, short and long term funding may impose financial and non-financial requirements or restrictions.

Short-term needs: such as working capital requirements from customers, suppliers and inventory.

Long-term needs: capital investment, R&D and business expansion.

Debt vs equity (suitability)

This is the age-old question in relation to business funding, sometimes known as ‘capital structure’. There is a trade-off between preserving ownership (equity) and cash flow obligations (debt). This should be considered part ‘art’ and part ‘science’, as each business is slightly unique and there is not necessarily one right answer. Debt adds financial risk to the business, but can generate greater returns for the equity owners. Much will depend on the risk appetite, ability to manage the risk and external risk factors.

Professional insight: The best time to arrange funding is before you need it. A pro-active approach to build a network will ensure availability. The planning process will help a business identify the most suitable options. It is always worthwhile engaging your business network and advisers to determine the most suitable funding structure, as it can be unique to all businesses.

4. Risk Management Allows Focus on What Matters

Risk and return are commonly seen as inextricably linked for businesses. Financial risk is an unavoidable part of running a business. The skill to set a risk appetite and manage financial risk effectively will create a competitive advantage, increasing cash, profits and return.

Risk management should not be an after-thought. Like the planning process, risk management will develop with consistent effort into a very powerful business tool. It can enable businesses to consider new horizons and possibilities, as well as improving the management of day-to-day operations. Good financial risk management will optimise current operations and help glean insights into the future.

A simple approach to start the risk management process:

Define a concise risk register

Focus only on the handful of financial risks that could materially impact the business. Avoid long, unmanageable lists. Examples might include:Customer concentration

Late payment risk

Currency exposure

Loss of funding facilities

Set tolerances and mitigation plans

For each risk try to quantify the impact and likelihood on a scale (say 1 to 5). Setting the scale will force a business to understand its risk appetite, and then for each risk on the register determine whether the business is near or outside of its appetite. But most importantly, create practical mitigation actions. Consider cash buffers, contractual protection, insurance or hedging to reduce the score against the scale.Expansion and change events

If a business is going through a significant change or period of growth, its risks and ways of managing will likely need to change. This should be a trigger for considering planning but also very importantly in the near-term risk management. Take international expansion as an example, there are numerous financial risks that need to be considered such as FX volatility, local banking constraints and tax rules.

Professional insight: Businesses will not be able to eliminate risk. The skill of managing risks can create significant competitive advantages and therefore value. Identify the risks and have a practical plan when things go wrong.

Treasury is Strategic Finance

Treasury is about optimising the present, both operations and financial risk to support fundamental business objectives. Also importantly, treasury a forward-thinking mindset, where consistent effort in processes and approach will develop into a competitive advantage.

Treasury objectives are fundamentally aligned to the strategy of any business.

Improve financial visibility and optimise cash flow

Support planning and decision-making

Build a funding structure with a strong network and the right type of facilities

Reduce operational issues in times of volatility or changes in the business

Why Financial Data Structure is Critical

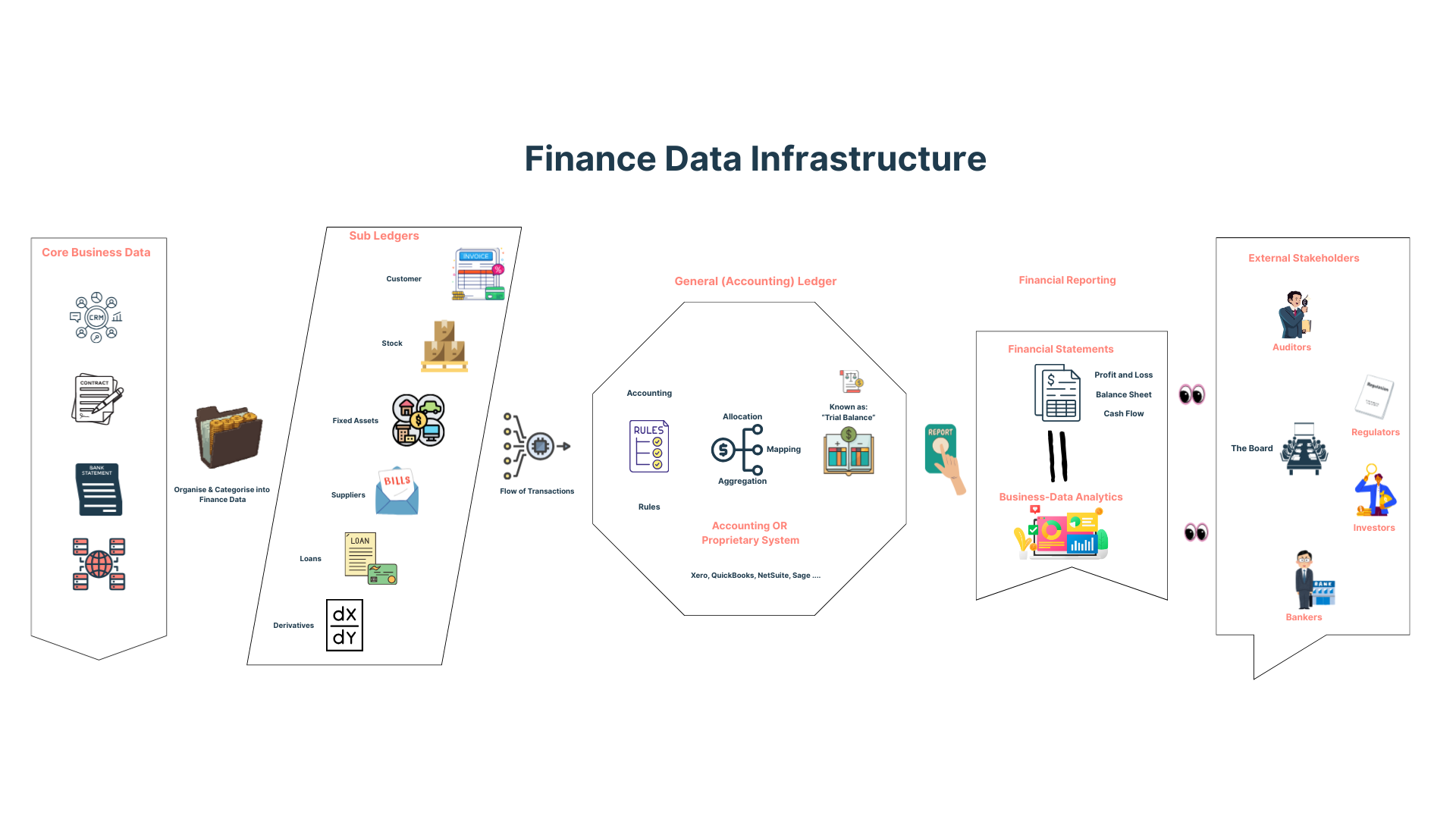

Implementing a robust financial data structure enables a business to accurately reflect its operations within its financial reporting. In turn, this facilitates clear and consistent communication with key external stakeholders such as investors, regulators, and banking partners. The result moves finance from a retrospective function to a strategic partner in decision-making.

The stereotype of a finance professional is an individual that likes structure, organisation, clear rules and clarity. There is often some truth in stereotypes, and for a finance professional such characteristics in their work creates confidence, reliability and trust. For most businesses these are the core attributes they need from their finance function.

At the heart of a strong finance function lies a well-structured financial data infrastructure. It is a collection of systems that easily and effectively capture business activity, turning that activity into accurate financial records. High quality data capture enables timely, reliable and insightful reporting.

It can seem complex and convoluted. Yet if implemented properly it can improve business operations, strategic insights and deal with the myriad of compliance requirements with ease.

1. Business Data is the Starting Point

Core business data is generated by frontline operations and activities. These operations and activities should be recorded within financial information and reflected in business performance so key stakeholders can understand and have oversight in a timely manner. Common data sources are as follows:

Customers

Contracts

Bank statements

Records of business events and actions

Each of these sources will have numerous events that carry financial consequence. The events must be collected, interpreted and stored in a structured manner as financial records.

2. From Subledgers to the General Ledger

Subledgers are the detailed records that organise and categorise core business data into financial data. Examples of typical subledgers are as follows:

Customers

Stock

Fixed assets

Suppliers

Projects

Transactions (from business events)

These subledgers can be held within and / or feed into finance infrastructure and systems, e.g. accounting systems like Xero, QuickBooks, NetSuite. In order to capture data within the subledgers effectively and ensure good data quality for processing into aggregated financial information, the subledgers must be able to meet the following requirements:

Transactions records are created automatically

Rules are applied to create consistency

Transaction data is mapped and allocated to subledger accounts (e.g. customers and suppliers)

Aggregation of various subledgers help produce the general (accounting) ledger, commonly referred to by accountants as the "trial balance".

The general ledger contains various ledger accounts to which subledger transactions are mapped. The aggregation of the general ledger accounts enable financial reporting, e.g. management accounts and financial statements.

The general ledger framework provides an accurate record of the business’s aggregate financial performance and position. It should be considered the ‘source of truth’ for financial performance as it is the backbone of the finance data infrastructure.

3. Financial Statements are a Representation of the Business

The various general ledger accounts simply need to be categorised in order to produce the key financial statements that are known to most businesses:

Profit & Loss (performance = results over a period)

Balance Sheet (position = a snapshot of financial health)

Cash Flow Statement (cash position and changes over a period)

The financial statements are vital for numerous compliance, reporting and strategic reasons:

They are tested and reported on by auditors and regulators

The board make decisions based on the financial information

The statements represent the financial and operational performance of the business to external stakeholders such as banks and investors

The financial statement framework then provides the basis needed for forecasting, budgeting and modelling. Without structured data feeding financial statements, funding conversations and strategic planning are undermined.

4. Turning Data into Insightful Strategy

By integrating core business data, subledgers and the general ledger, businesses create a strong foundation for business intelligence and analytics. This enables:

Real-time dashboards tailored to operational and financial KPIs

Forward-looking insights based on actual transactional data

Accurate trend analysis and variance tracking

These outputs move finance from a retrospective function to a strategic partner in decision-making. It helps business leaders evaluate options, assess risks and gain insights into business activity.

With the right data structure in place, the business benefits from full alignment. Key internal and external stakeholders all see the same version of the financial information and business activity. A robust shared view of financial performance and position builds confidence, enabling faster and better decisions.

Final Thoughts - From Chaos to Clarity

Implementing a robust financial data framework can seem daunting, but it is a path well-trodden for all businesses. Building automated and agile infrastructure adds significant value to a business. Not only does it easily ensure financial and reporting compliance. It enables a business to operate more effectively, scale rapidly, deal with change readily and unlock strategic decision-making.

A haphazard finance data infrastructure cedes confidence, drains resources and adds pressure from external stakeholders.

Structure and clarity breed confidence in the numbers and the business. Whether preparing for investment, tightening internal controls or simply looking to manage operations more effectively, the foundation is always the same.

Foreign Exchange Risk Management: Key Insights for Growing Businesses

Thinking about trading overseas, currency swings can make or break your profits. Discover why businesses face FX risks on par with global giants – and how a right-sized risk management plan can protect your margins and fuel sustainable international growth.

Many businesses have visions of lucrative and seamless international expansion, but the reality is more hard work to manage the process and associated financial risks. Managing increasing financial risk requires skill and know-how, otherwise the potential rewards of expansion can be eroded.

For growing businesses looking abroad, managing foreign exchange (FX) risk seems like a boring and technical subject matter that won’t materially impact the economics of the expansion. However, businesses are frequently caught out, either by doing nothing or implementing the wrong approach. It leads to reduced profits and in some cases burdensome liabilities.

The goal should be for this technical and boring subject matter not to detract from what the business is trying to achieve, bringing their product and services to new customers in a secure and sustainable way.

Why International Markets Matter for Growing Enterprises

There are numerous facts to quote as to the importance of global trade and SMEs increasing such activity, but here are a few highlights:

Small to medium sized enterprises (SMEs) contribute an estimated 20–40% of exports in major economies.

SMEs form the backbone of most economies, accounting for roughly 99% of businesses and two-thirds of private sector employment.

There is an “export gap”, which highlights the continuing untapped potential for SMEs trading abroad.

Modern technology and business approaches are changing perceptions and actions. Nearly half of UK mid-market companies plan to increase the number of countries they sell to, with 43% expecting higher revenue from abroad.

For many growing businesses, international expansion has become almost an expectation, as it is now far easier to access international markets. The venture needs to be conducted with some planning and risk management. Several governments and economic institutions have been encouraging businesses to expand overseas, yet with increasing economic and currency volatility it has meant unintended and challenging environments for many businesses. Businesses profit margins and financial stability have been materially impacted by currency fluctuations.

How Foreign Exchange Impacts International Expansion

The most effective way to consider the impact of the risk is by using recent examples. Below are some significant macroeconomic events, the corresponding impact on currency valuations and the potential impact on business profits.

Financial Crisis (2008): In a 6 month period from June to December 2008, the British Pound (GBP) depreciated 25-30% and the Euro (EUR) depreciated 20% against the US Dollar. It was a perfect storm for currency devaluation, global uncertainty and risk aversion meant a flight to the US Dollar as it is seen as a safe haven currency. With likely recessions in the UK & EU, and loosening monetary policy through reduced interest rates, made the assets and currencies of the economies less attractive to investors.

Brexit (2016–2020): In a 7 month period from May 2016 to December 2016, the British Pound (GBP) depreciated by up to 15%. Even during the UK’s Brexit negotiations there was extreme currency volatility. In one week of October 2019, GBP’s one-week implied volatility spiked above 17% and the currency’s value depreciated by 4%. Reacting to volatile markets will likely cause more harm than good as a business may act on a market spike that reverts shortly afterwards.

COVID-19 Pandemic (2020): The initial phase of the pandemic saw a similar flight to safety as the financial crisis as the US Dollar increased in value against the British Pound by 12% in 3 weeks during early to mid March 2020. Many based in the City of London will have a distinct memory of that sharp change. Yet swift central bank actions later stabilised markets, within 3 months the currencies were trading at similar levels prior to the outbreak of the pandemic. The pandemic is an apt example of how economic uncertainty manifests in currency markets, currencies are often more volatile than other asset classes making management even more delicate.

Mini-Budget (2022): The Liz Truss’s government in September 2022 held the commonly referred to “mini-budget”, leading to a small macroeconomic crisis for the UK economy as confidence dissipated due to plans for unfunded tax cuts. The sharp fall in the British Pound was one of the defining market reactions. The British Pound fell in value by 11% during September 2022, almost to parity against the US Dollar (1.035). It had been quite the fall for the Pound since mid-2008, when one British Pound could buy two US Dollars.

Recent Developments (2025): Trade wars and tariff announcements led to uncertainty that rattled FX markets. The US Dollar and Chinese Yuan experienced heightened volatility. The safe haven currency has been the Euro. The Euro has appreciated against the US Dollar by over 13% in 2025. An inverse move against the more recent flights to safety in the US Dollar, which has caught out a number of businesses and even financial institutions.

For a UK or European importer of US Dollar denominated goods, the currency devaluations of the financial crisis would have increased costs by 20-30%. The more recent strengthening of the Euro in light of the US trade tariffs could have seen US Dollar denominated revenues of European businesses reduce by over 13%. The currency move can be sudden and sharp, but the significant macroeconomic paradigm shifts generally maintains a long term change in currency valuation which can impact business profits (returns) by as much as 10-20%.

Another lesson to learn from recent macroeconomic history is that volatility can be short-lived. Currency markets are often at the forefront of investor sentiment, as seen with the Brexit negotiations, the Liz Truss “mini-budget” and the COVID-19 pandemic. Acting, or attempting to create plans during these periods, will often lead to a relatively extreme position in the long-run that will likely lead to an unfavourable outcome. Creating a plan, strategy and approach when expanding overseas will likely consider such extreme events. The real skill lies in the ability to execute the plan and make decisions based on an objective risk framework that has been established ahead of such events.

Our Research and Analysis

In some in-depth research, we analysed a sample of “growing” UK firms listed on the Alternative Investment Market (AIM) and compared them to a sample of large FTSE 100 multinationals. The results identified some clear themes:

the smaller AIM firms had FX exposures that were proportionately very similar to their FTSE 100 counterparts;

overseas revenue and costs made up a significant share of business for both groups;

the way the two groups managed the FX risk differed dramatically;

the AIM companies tended to have ad hoc or limited FX risk mitigation plans;

whereas the large corporates employed structured hedging programs and dedicated treasury resources.

In short, both small and large companies face material FX risks, but the smaller firms often lack the frameworks and resources that their larger peers use to deal with some of the currency volatility outlined above. The disparity suggests a clear opportunity for enterprises expanding overseas. Learning and adopting some of the best practices of larger firms, growing businesses can better protect themselves against the headache and noise of swings in currency valuation.

Future Content

There are a number of tools and techniques that can avoid management of currency risk being overly theoretical and impractical. We will try to use future blog posts and content to help businesses easily set a risk appetite, identifying where there are exposures, using the right tools to hedge or otherwise manage that risk, and reporting clear outcomes so that stakeholders stay informed. And for those with a desire and curiosity for the more technical elements, we can help explain the accounting, treasury and tax implications of hedging activity.