Why Financial Data Structure is Critical

The stereotype of a finance professional is an individual that likes structure, organisation, clear rules and clarity. There is often some truth in stereotypes, and for a finance professional such characteristics in their work creates confidence, reliability and trust. For most businesses these are the core attributes they need from their finance function.

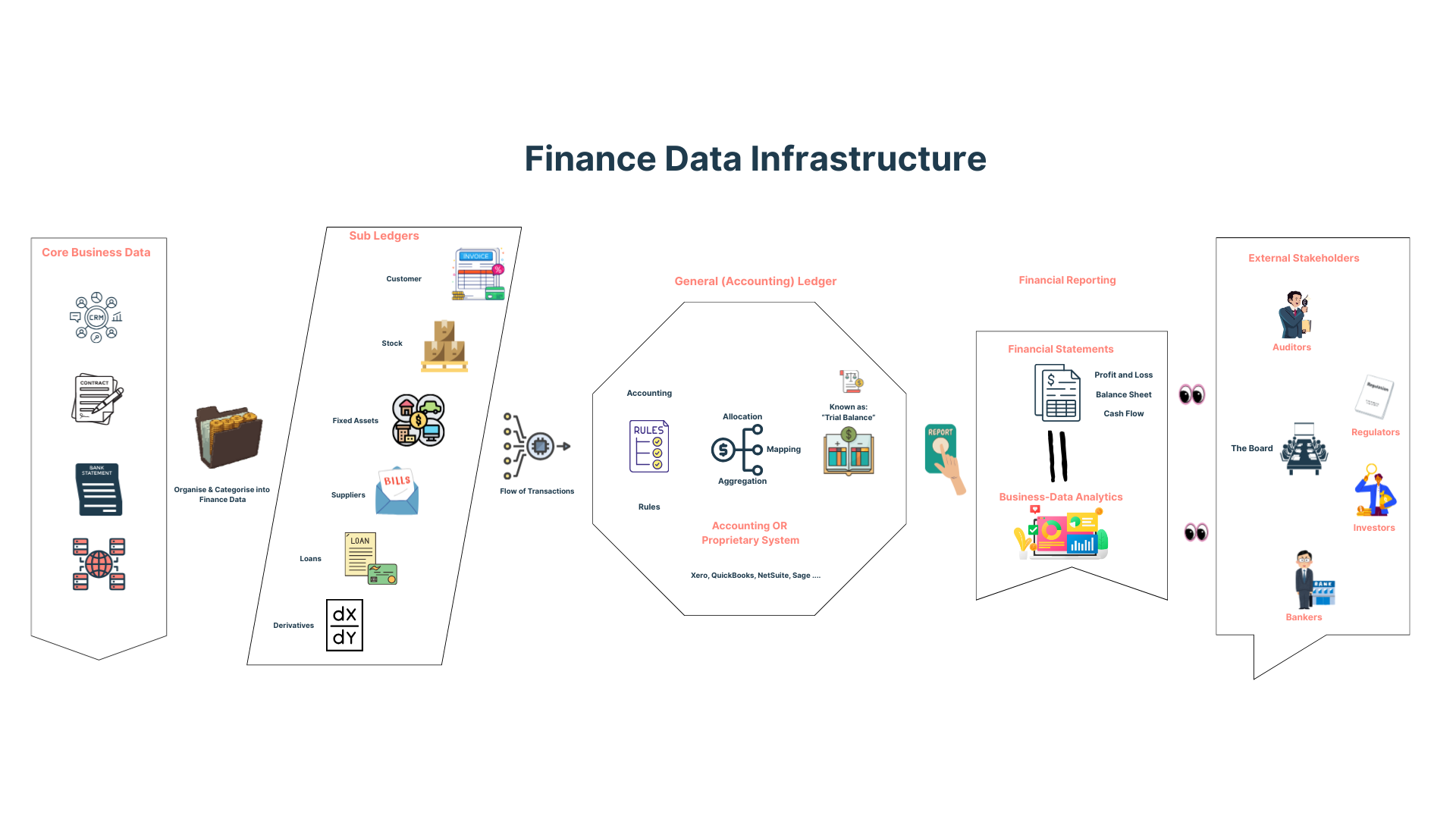

At the heart of a strong finance function lies a well-structured financial data infrastructure. It is a collection of systems that easily and effectively capture business activity, turning that activity into accurate financial records. High quality data capture enables timely, reliable and insightful reporting.

It can seem complex and convoluted. Yet if implemented properly it can improve business operations, strategic insights and deal with the myriad of compliance requirements with ease.

1. Business Data is the Starting Point

Core business data is generated by frontline operations and activities. These operations and activities should be recorded within financial information and reflected in business performance so key stakeholders can understand and have oversight in a timely manner. Common data sources are as follows:

Customers

Contracts

Bank statements

Records of business events and actions

Each of these sources will have numerous events that carry financial consequence. The events must be collected, interpreted and stored in a structured manner as financial records.

2. From Subledgers to the General Ledger

Subledgers are the detailed records that organise and categorise core business data into financial data. Examples of typical subledgers are as follows:

Customers

Stock

Fixed assets

Suppliers

Projects

Transactions (from business events)

These subledgers can be held within and / or feed into finance infrastructure and systems, e.g. accounting systems like Xero, QuickBooks, NetSuite. In order to capture data within the subledgers effectively and ensure good data quality for processing into aggregated financial information, the subledgers must be able to meet the following requirements:

Transactions records are created automatically

Rules are applied to create consistency

Transaction data is mapped and allocated to subledger accounts (e.g. customers and suppliers)

Aggregation of various subledgers help produce the general (accounting) ledger, commonly referred to by accountants as the "trial balance".

The general ledger contains various ledger accounts to which subledger transactions are mapped. The aggregation of the general ledger accounts enable financial reporting, e.g. management accounts and financial statements.

The general ledger framework provides an accurate record of the business’s aggregate financial performance and position. It should be considered the ‘source of truth’ for financial performance as it is the backbone of the finance data infrastructure.

3. Financial Statements are a Representation of the Business

The various general ledger accounts simply need to be categorised in order to produce the key financial statements that are known to most businesses:

Profit & Loss (performance = results over a period)

Balance Sheet (position = a snapshot of financial health)

Cash Flow Statement (cash position and changes over a period)

The financial statements are vital for numerous compliance, reporting and strategic reasons:

They are tested and reported on by auditors and regulators

The board make decisions based on the financial information

The statements represent the financial and operational performance of the business to external stakeholders such as banks and investors

The financial statement framework then provides the basis needed for forecasting, budgeting and modelling. Without structured data feeding financial statements, funding conversations and strategic planning are undermined.

4. Turning Data into Insightful Strategy

By integrating core business data, subledgers and the general ledger, businesses create a strong foundation for business intelligence and analytics. This enables:

Real-time dashboards tailored to operational and financial KPIs

Forward-looking insights based on actual transactional data

Accurate trend analysis and variance tracking

These outputs move finance from a retrospective function to a strategic partner in decision-making. It helps business leaders evaluate options, assess risks and gain insights into business activity.

With the right data structure in place, the business benefits from full alignment. Key internal and external stakeholders all see the same version of the financial information and business activity. A robust shared view of financial performance and position builds confidence, enabling faster and better decisions.

Final Thoughts - From Chaos to Clarity

Implementing a robust financial data framework can seem daunting, but it is a path well-trodden for all businesses. Building automated and agile infrastructure adds significant value to a business. Not only does it easily ensure financial and reporting compliance. It enables a business to operate more effectively, scale rapidly, deal with change readily and unlock strategic decision-making.

A haphazard finance data infrastructure cedes confidence, drains resources and adds pressure from external stakeholders.

Structure and clarity breed confidence in the numbers and the business. Whether preparing for investment, tightening internal controls or simply looking to manage operations more effectively, the foundation is always the same.